Growth vs. Value Rotation: The Pendulum Swings Again

Relative Rotation Graphs (RRG) are not just good tools to use in analyzing sector rotation; they’re also a valuable means for visualizing other market dynamics. The relationships between growth and value stocks, or large-cap vs. mid- and small-cap stocks and the combination of these two breakdowns of the market, are prime examples.

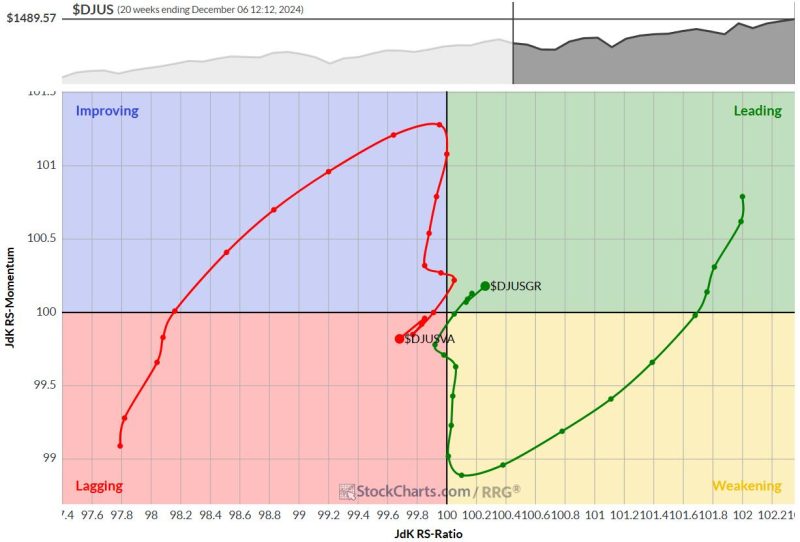

The pure growth-value rotation, as shown in the RRG above, tells an interesting story.

Value had its moment in the sun from August to early October, but the tides have turned since then. Around the week ending Sept 27, the value tail started to roll over while still inside the improving quadrant, while the growth tail did the opposite inside the weakening quadrant. Essentially, these signaled the end of a temporary countertrend move.

Now, it’s clear that growth is once again beating value.

Size Matters: Small- and Mid-Caps Take Center Stage

When we add the RRG showing rotations of large, mid, and small-cap stocks, the picture becomes even clearer. Small and mid-cap stocks are still gaining relative strength in the leading quadrant. Meanwhile, large caps are languishing in the lagging quadrant, continuing to lose ground.

A More Granular Look: Where the Action Is

Now, let’s get into the nitty-gritty. We get a more nuanced view by combining the breakdown of the US stock universe into growth and value with large-, mid-, and small-caps. The resulting RRG with six tails, three for growth and three for value broken down into three size segments, paints a vivid picture:

Mid- and small-cap growth stocks are the clear leaders, deep in the leading quadrant and heading further into it. Value small-cap and mid-cap stocks on the right side of the graph are holding their own, although they are losing some relative momentum. Both the large-cap tails inside the lagging quadrant show this segment’s current weakness.

Still, large-cap growth has just started to curl back up a bit while large cap value continues to head southwest. This means that large-cap value is now the weakest segment in the market, being inside the lagging quadrant and traveling on a negative RRG-Heading.

What This Means for Investors

Large-caps in general, particularly large-cap value, is best avoided for now. Small-cap and mid-cap growth stocks deserve your attention — they’re where the action is.

Market Outlook: Steady as She Goes

Despite these rotations, the overall outlook for the stock market in the coming weeks remains healthy.

The S&P 500 chart shows the rhythm of higher and lower lows is intact. Divergences causing concern have been negated, and breadth metrics have normalized—they’re no longer sending too many negative signals.

#StayAlert and have a great weekend. –Julius