First of all, I apologize for my absence this week. I caught something that looked like Covid, and felt like Covid, but it did not identify (pun intended) as Covid. Apart from feeling lousy, also my voice was gone, so making a video was not a good idea.

I am getting back into the trenches now (not 100% yet), at least with this short article, after an eventful week marked by a historic interest rate decision.

What’s happening in sector rotation?

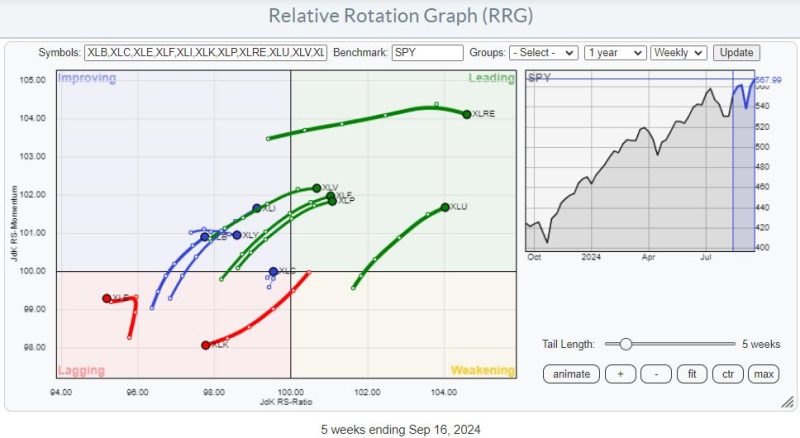

The weekly Relative Rotation Graph for US sectors above largely shows a continuation of the rotations set in motion a few weeks ago.

There has been a small increase in the energy and Communication Services sectors. Energy is far to the left inside the lagging quadrant and, based on RS-Ratio, the weakest sector at the moment. Communication Services is very close to the benchmark and on a very short tail, which has also been pretty erratic over the last few weeks.

The Real Estate sector inside the leading quadrant lost some steam (upside momentum), but based on RS-Ratio, it is still the strongest sector.

All other sectors remain on the same trajectory, with XLU, XLP, XLF, and XLV leading the dance into the leading quadrant. When slicing the sector universe into offensive, defensive, and sensitive, this means that all defensive sectors are inside the leading quadrant and traveling at a strong RRG heading.

Then, there are two offensive sectors also inside the leading quadrant: Financials and Real Estate, which are also very interest rate-driven sectors.

All sensitive sectors (XLI, XLE, XLK, XLC) are on the left hand side of the graph with only XLI showing a positive RRG heading.

Dilemma

But here’s my dilemma: The market’s response has been pretty bullish so far, with SPY breaking through overhead resistance this week. It pretty much ignores the defensive sector rotation but also the strong negative divergences between price and RSI/MACD.

So, do I go with the flow in the upward break and call off any risk for corrective action? Or do I stand by the analysis from a defensive sector rotation and pretty strong divergence signals from classical technical indicators for a little longer and try to see through the current bullishness?

Here’s the S&P chart, which shows the run-up to the late 2021 peak and the current market behavior.

The two charts above show the market behavior of 2021 up to the week of the upward break aligned with the current market.

These two RRGs show the rotation for defensive sectors around the peak in 2021-22 and the current.

Price Pays, but Don’t Bet The Farm

I am the first to admit that price pays, and you cannot buy the RSI or the MACD. Still, history makes me think that long-lasting negative divergences between price and these indicators, as we see them now, have proven to be pretty reliable—reliable enough for me not to go all-in and bet the farm on the upside.

Combine that with the current defensive sector rotation and the strong resemblance to the setup shortly before the market peaked in early 2022, and I strongly lean toward a “Let’s see how this plays out in coming weeks” approach.

#StayAlert (and don’t get sick ;), have a great weekend. –Julius