Alvopetro Energy (TSXV:ALV;OTCQX:ALVOF) is a pioneering independent natural gas producer in Brazil, and was the first company to deliver sales-specified natural gas onshore into the local distribution network, which the state oil company previously dominated. This marked the beginning of a new era in Brazil’s gas market.

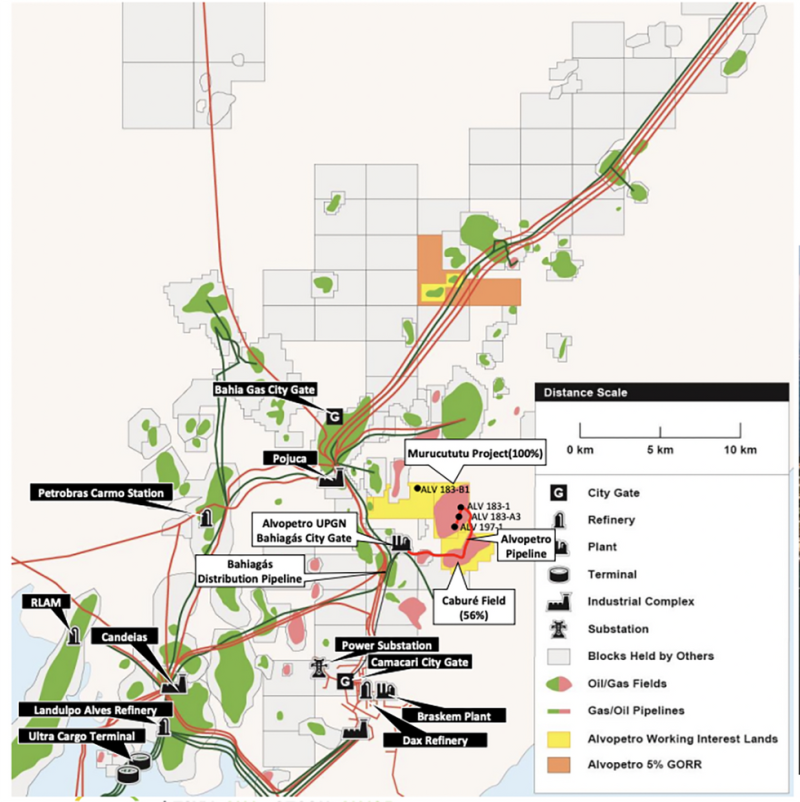

Alvopetro is an independent upstream and midstream operator that engages in the acquisition, exploration, development and production of natural gas and oil. The company’s interests in the Caburé and Murucututu includes Block 182 and 183 exploration assets, and Bom Lugar and Mãe-da-lua oil fields, which cover an area of over 22,000 acres in the Recôncavo basin onshore Brazil.

The company’s flagship Caburé asset (56 percent Alvopetro) delivers the majority of Alvopetro’s current production. The project is a joint development (the unit) of a conventional natural gas discovery across four blocks, two of which are held by Alvopetro and two of which are held by its partner, with Alvopetro’s working interest being 56.2 percent following the first redetermination. The unit currently includes eight existing wells, with all production facilities already in place. The resource is well defined with 3D seismic surveys, particularly on the eastern side of a main bounding fault that runs roughly north-south through the Caruaçu formation. The company plans to drill an additional five wells in late 2024 and early 2025 to further improve the productive capacity of the field.

Company Highlights

- Alvopetro is a leading independent upstream and midstream gas operator in the state of Bahia, Brazil.

- The company’s strategy is focused on unlocking Brazil’s on-shore natural gas potential, building off the development of its Caburé and Murucututu natural gas fields strategic midstream infrastructure.

- Over 95 percent of Alvopetro’s production is from natural gas and the company has a 2P reserve base of 9.6 MMboe.

- The company boasts high operating netbacks and profitability per unit of production, setting it apart from its Latin American and North American peers. The state of Bahia boasts a favorable fiscal regime with low royalties and a 15 percent income tax rate.

This Alvopetro Energy profile is part of a paid investor education campaign.*

Click here to connect with Alvopetro Energy (TSXV:ALV) to receive an Investor Presentation