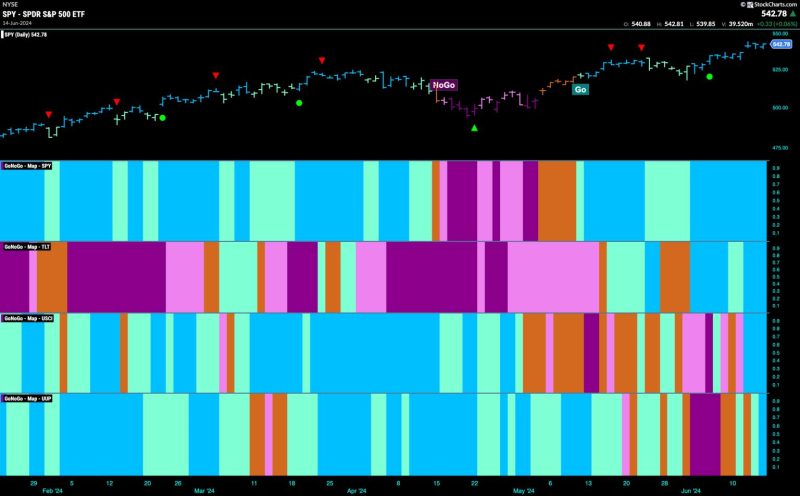

Good morning and welcome to this week’s Flight Path. Equities remained very strong this week as we saw a continued string of bright blue bars and a new price high. Treasury bond prices saw a surge in strength in the second half of the week as we see a return to bright blue bars. Commodities try to convince us that this time they’ve made up their mind and entered a “Go” trend on strong blue bars. Finally the dollar, after some uncertainty this week, closed with a strong blue “Go” bar as well.

$SPY Paints Strong Blue “Go” Bars at All Time Highs ( No Change this week!)

Not only did we see the “Go” trend continue this week but we saw price gap higher mid week and nothing but strength with GoNoGo Trend painting strong blue bars. When we turn our eye to the oscillator panel, we see that momentum is coming off an extreme of overbought. At a value of 5 but falling, we may well see a Go Countertrend Correction Icon (red arrow) appear above price informing us that it may struggle to go higher in the short term. We will pay attention to this and look to see if support is found at the gap.

The larger weekly chart shows that the “Go” trend remained very strong this week as we see a strong blue bar setting another higher weekly close. GoNoGo Oscillator has climbed to its max of 6. We will watch closely to see if this market enthusiasm can be maintained or if there is any waning of momentum which would cause a Go Countertrend Correction icon to appear on the chart above price.

Treasury Rates Set new Lower Low in “NoGo” Trend

After a brief relief rally that set a new lower high, we saw price fall through the second half of the week. GoNoGo Trend returned to paint more strong purple “NoGo” bars and price made a new lower low. We were alerted to this trend continuation mid week as GoNoGo Oscillator rose to test the zero line from below and was turned away. Now, with the “NoGo” firmly in place, we see that momentum is resurgent in the direction of the underlying trend. The oscillator is at a value of -3, not yet oversold.

Dollar Makes a Move after Uncertainty

After a few “Go Fish” bars, amber bars that reflect market uncertainty, we saw the dollar paint a couple of aqua bars this week before a strong blue “Go” bar was painted on Friday. Thursday’s “Go” bar was impressive, with its trading range completely engulfing that of the day before. This is known as a bullish engulfing pattern, and suggests higher price moves over the near term. Friday’s gap higher is above prior high levels and it will be important to note if we can consolidate at these levels. GoNoGo Oscillator is in positive territory on heavy volume after bouncing off the zero line.

The weekly chart shows a return to strength this week. GoNoGo Trend painted a strong blue “Go” bar as price challenges prior highs. GoNoGo Oscillator bounced off the zero line last week giving us signs of Go Trend Continuation (green circle). Now, momentum is positive and moving higher at a value of 3.